Investing in opportunities

for you.

Wilson Asset Management’s eight listed investment companies give investors access to the best companies in Australia, globally and in alternative assets.

Read our latest investment update.

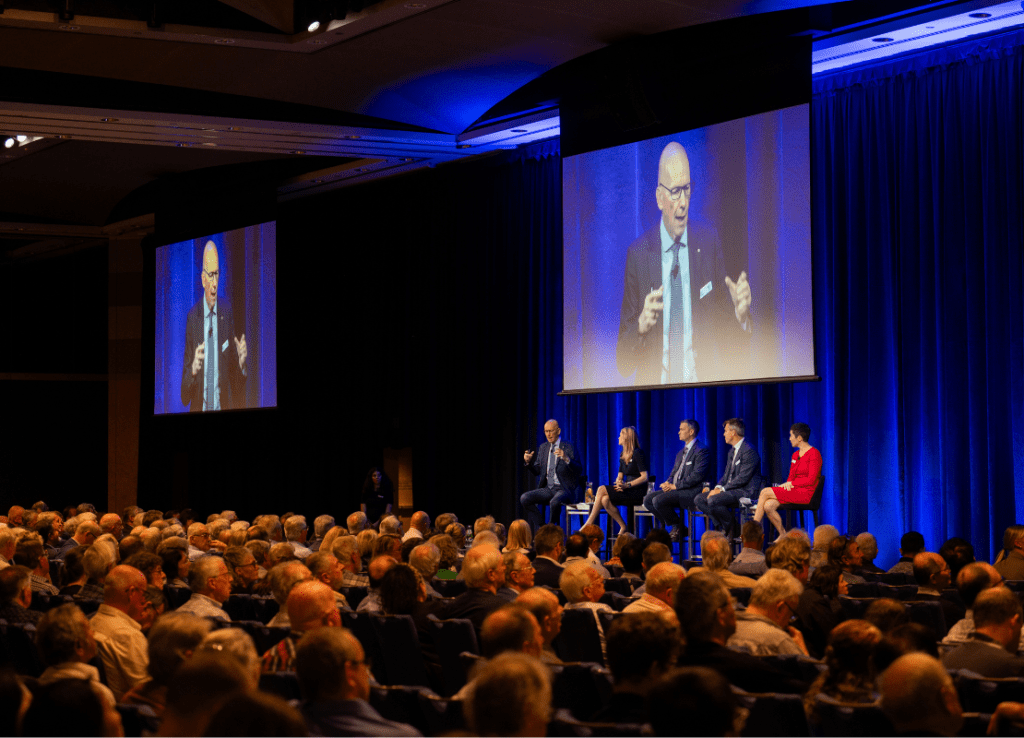

Making a difference for our shareholders and the community for more than 27 years

Wilson Asset Management was established with a purpose of making a difference for our shareholders and the community.

We invest over $5.9 billion on behalf of more than 130,000 retail investors as the investment manager of eight listed investment companies (LICs) and two unlisted funds: Wilson Asset Management Leaders Fund and Wilson Asset Management Founders Fund. Wilson Asset Management created and is the lead supporter of Future Generation Australia (ASX: FGX) and Future Generation Global (ASX: FGG), as well as Future Generation Women, the first Australian LICs to provide both investment and social returns.

Wilson Asset Management’s LICs offer investors exposure to a portfolio of companies in Australian micro, small, mid and large cap companies, global companies and in alternative assets. By owning shares in our LICs, you become a shareholder in a diversified portfolio that we manage on your behalf.

Our listed investment companies

Current Share Price

31 March 2025 pre-tax NTA $1.54

WAM Capital provides investors with exposure to an actively managed diversified portfolio of undervalued growth companies listed on the Australian Securities Exchange, with a focus on small-to-medium sized businesses. WAM Capital also provides exposure to relative value arbitrage and market mispricing opportunities. WAM Capital’s investment objectives are to deliver investors a stream of fully franked dividends, provide capital growth and preserve capital.

Current Share Price

31 March 2025 pre-tax NTA $1.25

WAM Leaders provides investors with exposure to an active investment process focused on identifying large-cap companies with compelling fundamentals, a robust macroeconomic thematic and a catalyst. The Company’s investment objectives are to deliver a stream of fully franked dividends, provide capital growth over the medium-to-long term and preserve capital.

Current Share Price

31 March 2025 pre-tax NTA $2.58

WAM Global provides investors with exposure to an actively managed diversified portfolio of undervalued international growth companies and exposure to market mispricing opportunities. WAM Global’s investment objectives are to deliver investors a stream of fully franked dividends, provide capital growth over the medium-to-long term and preserve capital.

Current Share Price

31 March 2025 pre-tax NTA $1.10

WAM Research provides investors with exposure to a diversified portfolio of undervalued growth companies, which are generally small-to-medium sized industrial companies listed on the ASX. WAM Research’s investment objectives are to provide a stream of fully franked dividends and achieve a high real rate of return, comprising both income and capital growth, within acceptable risk parameters.

Current Share Price

31 March 2025 pre-tax NTA $0.79

WAM Active provides investors with exposure to an active trading style with the aim of achieving a sound return with a low correlation to traditional markets. WAM Active’s investment objectives are to deliver a regular income stream via fully franked dividends, provide a positive return with low volatility, after fees, over most periods of time, and to preserve capital.

Current Share Price

31 March 2025 pre-tax NTA $1.40

WAM Microcap provides investors access to a portfolio of undervalued micro-cap growth companies with a market capitalisation of less than $300 million at the time of acquisition. WAM Microcap also provides exposure to relative value arbitrage and market mispricing opportunities. WAM Microcap’s investment objectives are to deliver a stream of fully franked dividends, provide capital growth over the medium-to-long term and preserve capital.

Current Share Price

31 March 2025 pre-tax NTA $1.20

WAM Alternative Assets is the only listed investment company on the ASX that offers investors access to a diversified portfolio of alternative assets, typically accessible only by institutional investors. The Company's investment objectives are to consistently deliver absolute returns through a combination of dividend yield and capital growth, while providing diversification benefits.

Current Share Price

31 March 2025 pre-tax NTA $1.25

WAM Strategic Value provides shareholders with exposure to Wilson Asset Management’s proven investment process focused on identifying and capitalising on share price discounts to underlying asset values of listed companies, primarily listed investment companies (LICs) and listed investment trusts (LITs) (commonly referred to as closed-end funds).

Current Share Price

31 March 2025 pre-tax NTA $1.35

Future Generation Australia gives investors the opportunity to gain unprecedented access to a group of prominent Australian fund managers in a single investment vehicle while supporting Australian not-for-profit organisations focused on children and youth at risk.

Current Share Price

31 March 2025 pre-tax NTA $1.66

Future Generation Global is Australia’s first internationally focused listed investment company with the dual objectives of providing shareholders with diversified exposure to selected global fund managers and supporting not-for-profit organisations focused on promoting wellbeing and preventing mental ill-health in young Australians.