By Geoff Wilson AO

I am currently in the US, witnessing the market breadth improving as the dominance of the Magnificent Seven declines.

We are in a US presidential election year, and since 1928 election years have been positive for equity markets, with the S&P 500 Index increasing 7.5% on average, 75% of the time. Also, when the S&P 500 Index hits a record high, being the first record in at least 12 months, since 1928 84.6% of the time the S&P 500 Index was higher 12 months later with an average increase of 13.08%.

This period may also coincide with central banks globally pausing and potentially cutting interest rates.

Structural benefits of listed investment companies (LICs)

Research shows that a closed-end pool of capital like a LIC will outperform an open-end pool of capital like a managed fund or exchange traded fund (ETF) over time. The reason is, an open-end pool of capital is impacted by money flows, both inflows and outflows. When money flows into an open-end fund, additional shares have to be bought. When money flows out of an open-end fund, shares have to be sold. Usually, investors redeem their investments at the wrong time, when the market has fallen and stocks are cheap, and conversely money flows in to open-end funds when the market has already risen and stocks are more expensive. Thus, an open-end fund is more likely to be buying at the top of the market and a forced seller at the bottom of the market. The LIC is a stable, closed pool of money and can be invested for the medium-to-long term without being impacted by money flows, providing the LIC with a significant competitive advantage. It is interesting to note that when Warren Buffet started investing he invested a lot of his money in closed-end funds like LICs.

The value in a discount

Over four decades in financial markets, one of my greatest passions has centred on identifying, investing in and profiting from buying assets cheaply. Essentially, identifying and investing in $1 of assets for 80 cents or less. Premiums and discounts are only one element of LICs. A common assumption made by LIC investors is that premiums are positive, while discounts are negative. I believe this definition is oversimplified and misses the opportunity of investing in discounted assets.

“As Warren Buffet said: if you are planning to purchase hamburgers, you want the price of hamburger meat to fall, not rise.”

LICs that have historically fluctuated between discounts and premiums can present an opportunity as the discount narrows, particularly when a catalyst is identified that will close the gap between the share price and NTA. Additionally, investing in discounts can have the added advantage of providing access to quality investment managers and a diversified portfolio of assets cheaply, as well as purchasing securities paying a strong fully franked dividend yield at a lower price. Investing in discounted assets allows investors to supercharge their returns by generating returns from the investment manager performance, in addition to the narrowing of the discount.

WAM Strategic Value (ASX: WAR) specifically aims to take advantage of the market mispricing opportunities, including securities trading at discounts to assets or NTA, corporate transactions and dividend yield arbitrages with franking credit benefits. Our experience and expertise in managing closed-end vehicles provides us with a unique position and methodology to identify and benefit from LIC and listed investment trust (LIT) market mispricing opportunities. The value differential is realised when the investment is sold at a price which reflects, or more closely reflects, the value of the investment’s underlying assets. WAM Strategic Value aims to realise some or all of this value as part of our investment strategy, and in doing so, provides an alternative source of market outperformance compared to other common stock-selection strategies. The value presented by discounted assets can be realised through the use of existing catalysts, regular and meaningful engagement with boards, management teams and other investors, and shareholder activism where necessary.

The LIC and LIT sector

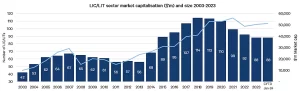

The sector hs experienced numerous cycles of expansion and contraction since the first closed-end fund was listed in London in 1868. In the early 2000s, the Australian LIC and LIT sector experienced significant growth, which was followed by a period of consolidation. After the levelling of the playing field with the Future of Financial Advice (FOFA) reforms in 2012, the sector expanded significantly from 56 LICs and LITs in 2013 to a peak of 114 in 2018. Today, there are 88 LICs and LITs trading on the ASX. As you can see from the ‘LIC/LIT sector market capitalisation and size’ chart below, the market capitalisation of the sector has remained strong despite the overall number of LICs and LITs decreasing, highlighting the consolidation of the sector more recently.

Throughout 2024, we anticipate further consolidation and restructuring in the sector, particularly with LICs and LITs that have failed to properly engage with their shareholders. This consolidation phase is a healthy part of the LIC and LIT business cycle.

I have changed my handle on X and can now be followed at @GeoffWilsonWAM.