Anthony Albanese has set up a class war fight with Peter Dutton over superannuation after breaking an election promise and doubling tax rates for 80,000 Australians with nest eggs above $3m.

The $2bn-a-year tax hit was rushed through cabinet on Tuesday despite the Prime Minister and Jim Chalmers ruling out increases to super taxes and caps during last year’s election campaign.

The superannuation crackdown was announced 30 minutes after the Treasurer used new Treasury figures to warn that the 10 largest annual concessions, credits and deductions for super, family trusts, housing, franking credits and GST had blown out to more than $150bn.

Mr Albanese said Labor would take the super tax hit to the 2025 federal election but acknowledged the new measure would feature in the May 9 budget and be legislated in the current term of parliament.

Despite the Coalition’s opposition to the super changes, Labor appeared to be close to gaining Senate support for the increased tax. Greens leader Adam Bandt said on Tuesday night he was open to the proposals while claiming the government was “robbing Peter to pay Paul” by not getting rid of the stage three tax cuts.

Independent senator David Pocock who has previously called for a clampdown on super tax concessions said he was looking at the proposals. “Starting to wind back tax concessions for people with millions of dollars in superannuation will allow the budget to work harder for people most in need,” Senator Pocock said.

Labor needs the votes of the Greens and two other crossbenchers to pass legislation.

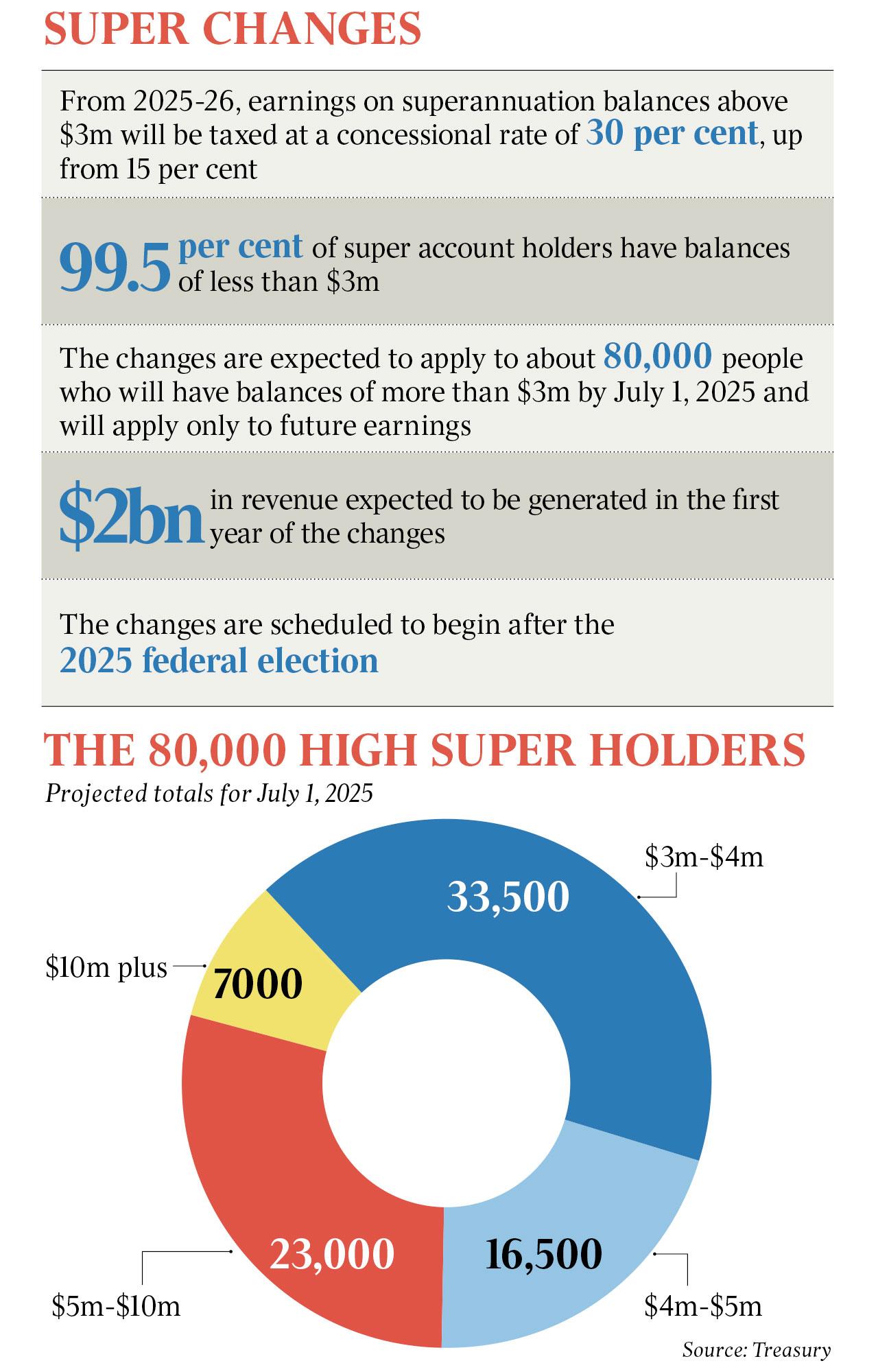

The increased super tax will have an impact on 33,500 Australians with $3m-$4m in super, 16,500 who have $4m-$5m in savings, 23,000 with nest eggs between $5m and $10m and 7000 who have more than $10m.

Under the changes, which commence from July 1, 2025, super balances above $3m will be hit with a concessional rate of 30 per cent rather than 15 per cent.

With a lead-in time of just over two years, Treasury is assuming that some people hit by the policy are likely to withdraw money out of the superannuation system.

The expenditure review committee of cabinet met on Monday night to rubber stamp the policy, only seven days after Dr Chalmers launched a national conversation that he claimed would “end the super wars”. As recently as Sunday night when pressed on potential changes to the super system, Mr Albanese told the Ten Network: “We are having a discussion about the purpose of superannuation. This is all hypothetical.”

The super tax, which is understood to have been watered down following fierce pushback over the past week, came after Dr Chalmers last Monday said the government would legislate a defined purpose for superannuation focused on “equity, sustainability and providing a dignified retirement for workers”.

Mr Albanese said the tax change did not undermine the fundamentals of the superannuation system, with 99.5 per cent of people “unaffected by this reform”.

Dr Chalmers said the government intended to apply a similar tax rate of 30 per cent for those on generous defined benefit schemes, including retired politicians, public servants and judges. Mr Albanese is eligible for the defined benefits scheme.

The Treasurer said he supported Australians saving large amounts of money for their retirement. “We don’t begrudge anyone who has made a lot of money, or saved a lot of money, or takes advantage of the tax breaks that are legitimately available to them,” he said.

Asked whether the government would target capital gains tax, which includes a $48bn-a-year exemption on the family home, the Treasurer told ABC’s 7.30: “No, we’re not proposing to act on that. We’re proposing to act on superannuation for all of the reasons that I have outlined tonight.”

The Australian understands broadening the super hit is complicated by Treasury not having up-to-date figures on how many Australians are eligible under defined benefit schemes, which were closed off in the 1990s and guarantee either lump sums or fixed yearly payments.

Opposition Treasury spokesman Angus Taylor said Labor had broken election promises on superannuation, industrial relations and slashing power bills by $275. Mr Taylor warned that Dr Chalmers’ revamped Tax Expenditures and Insights Statement (TEIS), outlining the cost of negative gearing, capital gains tax discounts, franking credits, family trust and super concessions, was a precursor to future raids on families, households and businesses.

Mr Albanese, who repeatedly said he would end class warfare ahead of last year’s election, goaded Mr Dutton to “stand up for” high-wealth individuals with over $100m in their super accounts. “It’s after the next election,” the Prime Minister said. “It’s also not retrospective. It applies to future earnings. Australians who are having to make tough decisions around the kitchen table expect their government to be prepared to make tough decisions around the cabinet table.

“If Mr Dutton chooses to stand up for the individual with over $400m in their account, and the 17 people who have over $100m, well, that’s a matter for him, and he can make those decisions and people can look at the fiscal implications of that after the next election when we get to it.”

Mr Albanese said revenue raised from the super change would “contribute $900m to the bottom line over the forward estimates and some $2bn when it is operating on a full-year period”.

After releasing the TEIS on Tuesday, Dr Chalmers said Treasury’s analysis showed the majority of super tax breaks went to high-income earners.

Mr Taylor said Mr Albanese and Dr Chalmers had walked away from their commitment not to add taxes to superannuation.

He said the TEIS laid out “more than $150bn of additional taxes” that Labor could impose by targeting CGT, negative gearing and franking credits.

Mr Albanese, who dumped Bill Shorten’s election-losing 2019 policies after becoming Labor leader, ruled out further changes to the superannuation system. Asked if he would rule out changes to negative gearing, Dr Chalmers said the government’s focus was on super tax breaks.

Self-Managed Super Fund Association policy director Peter Burgess hit out at Labor’s plan because it eroded consumer confidence in the system.

“When you have caps, there is always the danger that they could be reduced,” Mr Burgess said.

ANU Centre for Social Research and Methods associate professor Ben Phillips said the $50bn in superannuation tax concessions were “the lowest hanging fruit” among the big-ticket items identified by Treasury. He said the changes were reasonable and “a good first step” but he would have preferred a lower $2m threshold for super balances.

Independent economist Chris Richardson said: “I would love to see root and branch reform of the superannuation system; this isn’t it, but it’s a reasonable change on its own”.

Cbus Super chief executive Justin Arter said: “If you have tens or even hundreds of millions in your super account you aren’t really working to secure your own retirement.”

Wilson Asset Management chair Geoff Wilson said the proposed reforms coupled with proposed changes around franking credits removed incentives for high-wealth retirees to invest in Australian companies.

Licensed by Copyright Agency. You must not copy this work without permission.