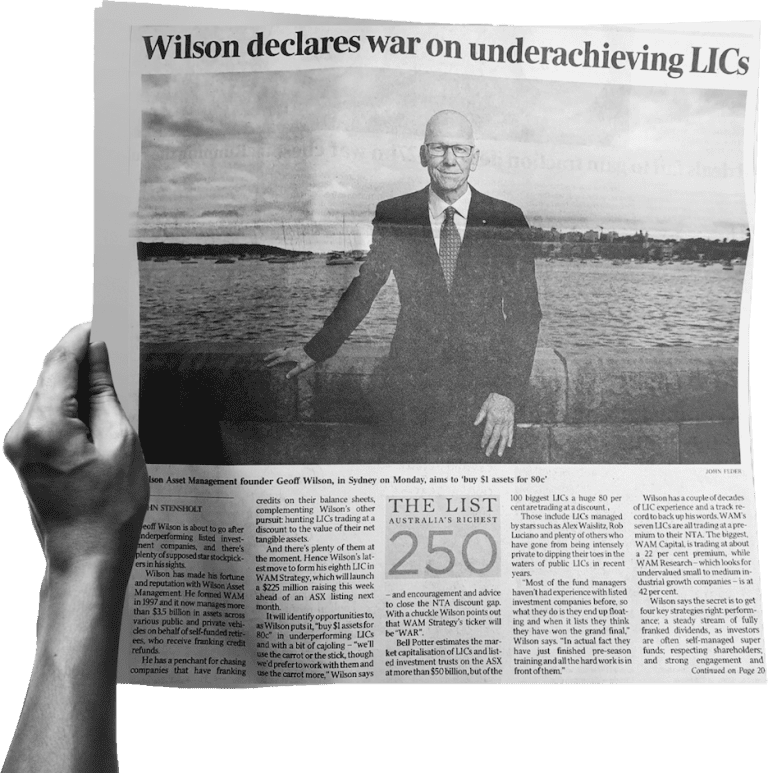

Established in 1997 by Geoff Wilson AO, Wilson Asset Management is an independently owned investment manager based in Sydney, Australia. As the investment manager for eight leading listed investment companies (LICs) listed on the ASX as well as the Wilson Asset Management Leaders Fund, Wilson Asset Management invests over $5 billion on behalf of more than 130,000 retail investors. Wilson Asset Management created and is the lead supporter of the first LICs to deliver both investment and social returns: Future Generation Australia (ASX: FGX) and Future Generation Global (ASX: FGG).

Wilson Asset Management advocates and acts for retail investors, is a member of the global philanthropic Pledge 1% movement, is a significant funder of many Australian charities and provides all team members with $10,000 each year to donate to charities of their choice. All philanthropic investments are made by the investment manager.