31 January 2025

Listed: January 2008

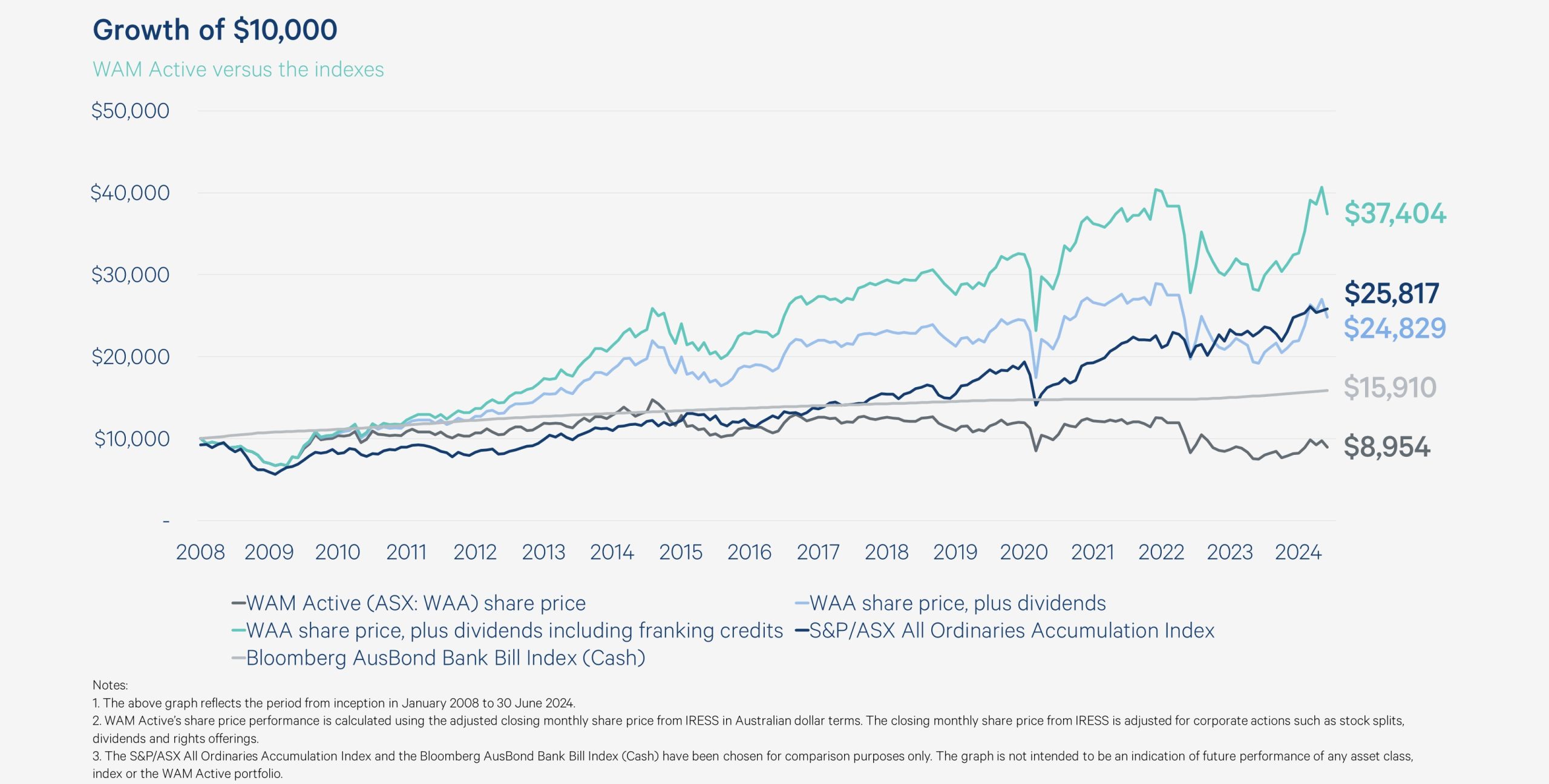

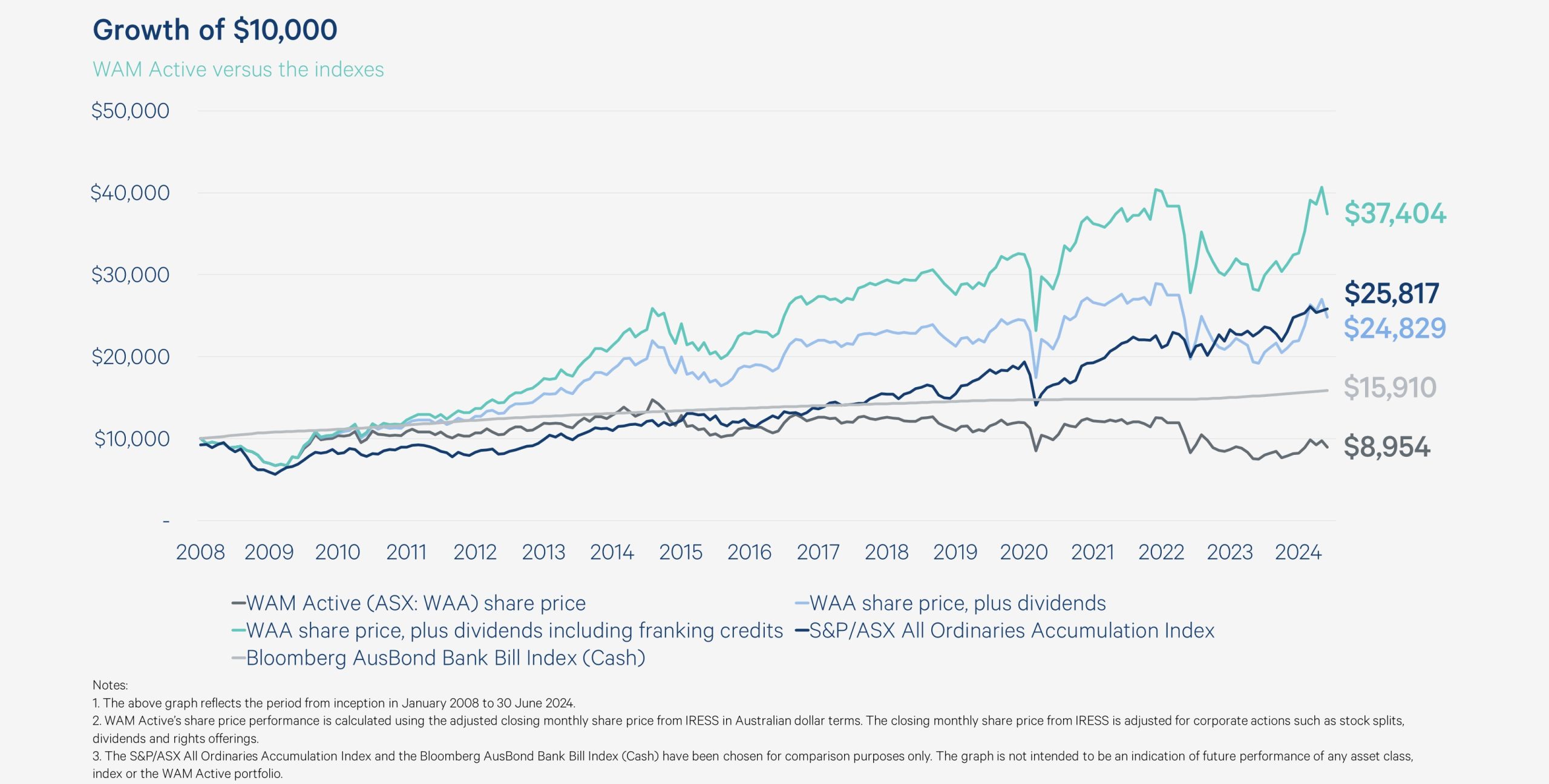

WAM Active provides investors with exposure to an active trading style with the aim of achieving a sound return with a low correlation to traditional markets. WAM Active’s investment objectives are to deliver a regular income stream via fully franked dividends, provide a positive return with low volatility, after fees, over most periods of time, and to preserve capital.

NTA before tax

$0.86

Annualised interim dividend

6.0cps

Fully franked dividend yield

7.1%

Grossed-up dividend yield

10.1%

Dividends paid since inception

98.7cps

Dividends paid since inception, when including the value of franking credits

141.0cps

Assets

$66.6m

Investment portfolio performance (% p.a. since January 2008)

11.5%

Investment portfolio performance is before expenses, fees and taxes to compare to the relevant indexes which are also before expenses, fees and taxes.

Our proven market driven investment process

Takes advantage of short-term mispricing opportunities in the Australian equity market.

Our proven market driven investment process

Board of Directors

Geoff Wilson has more than 44 years’ direct experience in investment markets having held a variety of senior investment roles in Australia, the UK and the US. Geoff founded Wilson Asset Management in 1997, which today, comprises of 20 investment professionals who offer a combined investment experience of more than 200 years. Wilson Asset Management manages over $5 billion on behalf of more than 130,000 investors as the investment manager for eight listed investment companies and the Wilson Asset Management Leaders Fund. Geoff is currently Chairman of WAM Capital Limited, WAM Leaders Limited, WAM Global Limited, WAM Microcap Limited, WAM Research Limited, WAM Active Limited and WAM Strategic Value Limited. He is the founder and Director of Future Generation Australia Limited and Future Generation Global Limited, and Director of WAM Alternative Assets Limited. In 2014 Geoff created Australia’s first listed philanthropic wealth creation vehicles, Future Generation Australia, and subsequently Future Generation Global in 2015. In 2024 Geoff launched Future Generation Women as the first all-female managed fund in Australia, delivering investment returns and advancing economic equality and opportunities for women and their children in Australia. To date, the Future Generation companies have donated more than $87 million to Australian not-for-profits. Geoff holds a Bachelor of Science, a Graduate Management Qualification and is a Fellow of the Financial Services Institute of Australia and the Australian Institute of Company Directors (AICD). In addition to Geoff’s Directorships with the Wilson Asset Management Group and the Future Generation companies, he also holds Directorships with Global Value Fund (since 2014), Hearts and Minds Investments Limited (since 2018), Sporting Chance Cancer Foundation (since 1997) and the Australian Rugby Foundation (2024).

Kate Thorley has over 20 years’ experience in the funds management industry and more than 25 years of financial accounting and corporate governance experience. Kate is the Chief Executive Officer of Wilson Asset Management, Director of WAM Capital, WAM Leaders, WAM Global, WAM Research, WAM Active, WAM Microcap and WAM Strategic Value. Kate is a Director of Future Generation Australia and Future Generation Global. Kate is a graduate member of the Australian Institute of Company Directors and is a Chartered Accountant.

Karina Kwan is a non-executive director of several boards. Her board contribution includes strategic, financial and risk-governance expertise, leveraging over 36 years’ experience in financial services. Karina has led an accomplished executive career, including the roles of Chief Financial Officer of Citi Australia & New Zealand, and General Manager/CFO of the corporate center divisions of the Commonwealth Bank of Australia. Karina holds a Bachelor of Economics (University of Sydney), is a Fellow Certified Practicing Accountant of CPA Australia, and a Graduate of the Australian Institute of Company Directors. Karina formerly served on the Board of Advice of the University of Sydney Business School. She currently serves and has formerly served on the advisory board of several fintech startups.

Simon Poidevin has worked in global financial markets for over 39 years, spending 14 years with Citigroup, culminating in heading the firm’s Corporate Equity Broking division in Australia. Simon was previously Managing Director, Corporate Broking at Bell Potter Securities Limited from 2013 to 2020. He is currently a non-executive Director of Stealth Global Holdings Limited (ASX: SGI), an Advisory Board Member of leading Safe Harbour insolvency firm Wexted Advisors and a board member of the UNSW Foundation. Simon holds a Bachelor of Science (Hons) and represented Australia in Rugby Union from 1980 to 1992, captaining the Wallabies in 1986 and 1987 and becoming the first Wallaby to play 50 tests. He was inducted into the Sport Australia Hall of Fame in 1991 and the Australian Rugby Hall of Fame in 2014.

Linda has over 20 years’ experience in financial accounting including more than 15 years in the funds management industry. As the Finance Manager of Wilson Asset Management (International) Pty Limited, Linda oversees finance and accounting and is also the Joint Company Secretary for six listed investment companies, WAM Capital Limited, WAM Leaders Limited, WAM Global Limited, WAM Microcap Limited, WAM Research Limited and WAM Active Limited. Linda holds a Bachelor of Commerce and is a fully qualified CPA. She is a certified member of the Governance Institute of Australia. Linda was appointed Company Secretary of WAM Active Limited in February 2016.

Jesse is a Chartered Accountant with more than 16 years’ experience working in advisory and assurance services, specialising in funds management. As the Chief Financial Officer, Jesse oversees all finance and accounting of Wilson Asset Management (International) Pty limited. Jesse is currently a non-executive director of the Listed Investment Companies & Trusts Association, Company Secretary for WAM Alternative Assets Limited and WAM Strategic Value Limited and Joint Company Secretary for WAM Capital Limited, WAM Leaders Limited, WAM Global Limited, WAM Microcap Limited, WAM Research Limited and WAM Active Limited, in addition to Future Generation Australia Limited and Future Generation Global Limited. Prior to joining Wilson Asset Management, Jesse worked as Chief Financial Officer of an ASX listed company, and also as an advisor specialising in assurance services, valuations, mergers and acquisitions, financial due diligence and capital raising activities for listed investment companies. Jesse was appointed Joint Company Secretary of WAM Active Limited in November 2020.

Fully franked dividends

Our LICs have a proven track record of providing shareholders with a stream of fully franked dividends.

Diversification

Our LICs offer investors exposure to different market sectors and asset classes through their various underlying investments.

Experienced team

The investment team is comprised of 20 professionals who offer a combined experience of more than 200 years in Australian and international equity markets as well as in alternative assets.

Superior structures

The LIC structure allows us to invest for the long term, without being subject to the impact of applications and redemptions. LICs also adhere to strict corporate governance requirements and act in the best interest of shareholders.

Strong performance

We offer a strong track record of performance based on our rigorous investment process.

Risk-adjusted returns

Our flexible investment mandate allows above-average cash holdings and strong, risk-adjusted returns.

Full market access

We hold over 4,000 company meetings each year, and our knowledge of the market and extensive network continually provides valuable intelligence and investment opportunities.

Transparency & engagement

We provide email updates from our Lead Portfolio Managers and investment team, Chairman and CIO, timely market insights in the form of podcasts, articles and videos, in-person presentations, investor education materials and financial reporting.

Type

- Annual report

- Anti-bribery and corruption policy

- Appointment of Wilson Asset Management as Investment Manager

- Chairman's address

- Corporate governance charter

- Corporate governance statement

- Dividend reinvestment plan

- Entitlement offer booklet

- Entitlement offer fact sheet

- Fact sheet

- Financial report

- Independent research report

- Interim financial report

- Investment Approach

- Key dates

- Media release

- Modern slavery statement

- Monthly investment update

- Notice of meeting

- Option prospectus

- Presentation

- Prospectus

- Share purchase plan

- Share purchase plan announcement

- Share purchase plan booklet

- Target market determination

- Term sheet

- Whistleblower policy

- Withdrawal form

Item

- WAM Active FY2025 Interim Financial Reportpdf

- WAM Active FY2025 Half Year Resultpdf

- WAM Active Monthly Investment Update January 2025pdf

- WAM Active Monthly Investment Update December 2024pdf

- WAM Active Monthly Investment Update November 2024pdf

- WAM Active Chairman’s Address 2024pdf

- WAM Active Monthly Investment Update October 2024pdf

- WAM Active Notice of Meeting 2024pdf

- WAM Active Monthly Investment Update September 2024pdf

- WAM Active Monthly Investment Update August 2024pdf

- WAM Active Corporate Governance Statement 2024pdf

- WAM Active Corporate Governance Charter 2024pdf

- WAM Active FY2024 Annual Reportpdf

- WAM Active FY2024 Full Year Resultpdf

- WAM Active Monthly Investment Update July 2024pdf

- WAM Active Monthly Investment Update June 2024pdf

- WAM Active Monthly Investment Update May 2024pdf

- FY2024 Key Datespdf

- WAM Active FY2024 Half Year Resultpdf

- WAM Active Monthly Investment Update April 2024pdf

- WAM Active Monthly Investment Update March 2024pdf

- WAM Active Monthly Investment Update February 2024pdf

- WAM Active FY2024 Interim Financial Reportpdf

- WAM Active Monthly Investment Update January 2024pdf

- WAM Active Whistleblower Policy 2023pdf

- WAM Active Monthly Investment Update December 2023pdf

- WAM Active Modern Slavery Statement 2023pdf

- WAM Active Monthly Investment Update November 2023pdf

- WAM Active Monthly Investment Update October 2023pdf

- WAM Active Chairman’s Address 2023pdf

- WAM Active Monthly Investment Update September 2023pdf

- WAM Active Notice of Meeting 2023pdf

- FY2023 Key Datespdf

- WAM Active Monthly Investment Update August 2023pdf

- WAM Active Corporate Governance Statement 2023pdf

- WAM Active Corporate Governance Charter 2023pdf

- WAM Active FY2023 Annual Reportpdf

- WAM Active FY2023 Full Year Resultpdf

- WAM Active Monthly Investment Update July 2023pdf

- WAM Active Monthly Investment Update June 2023pdf

- WAM Active Monthly Investment Update May 2023pdf

- WAM Active Monthly Investment Update April 2023pdf

- WAM Active Monthly Investment Update March 2023pdf

- FY2023 Key Datespdf

- WAM Active Monthly Investment Update February 2023pdf

- WAM Active FY2023 Interim Financial Reportpdf

- WAM Active FY2023 Half Year Resultpdf

- WAM Active Monthly Investment Update January 2023pdf

- WAM Active Monthly Investment Update December 2022pdf

- WAM Active Monthly Investment Update November 2022pdf

- WAM Active Monthly Investment Update October 2022pdf

- WAM Active Notice of Meeting 2022pdf

- WAM Active Monthly Investment Update September 2022pdf

- FY2022 Key Datespdf

- WAM Active Monthly Investment Update August 2022pdf

- WAM Active FY2022 Annual Reportpdf

- WAM Active Corporate Governance Statement 2022pdf

- WAM Active FY2022 Full Year Resultpdf

- WAM Active Corporate Governance Charter 2022pdf

- WAM Active Monthly Investment Update July 2022pdf

- WAM Active Monthly Investment Update June 2022pdf

- WAM Active Monthly Investment Update May 2022pdf

- WAM Active Chairman’s Address 2022pdf

- WAM Active Monthly Investment Update April 2022pdf

- WAM Active Monthly Investment Update March 2022pdf

- FY2022 Key Datespdf

- WAM Active Monthly Investment Update February 2022pdf

- WAM Active FY2022 Interim Financial Reportpdf

- WAM Active Monthly Investment Update January 2022pdf

- WAM Active FY2022 Half Year Resultpdf

- WAM Active Monthly Investment Update December 2021pdf

- WAM Active Whistleblower Policy 2022pdf

- WAM Active Modern Slavery Statement 2021pdf

- WAM Active Monthly Investment Update November 2021pdf

- WAM Active appoints Director Simon Poidevinpdf

- WAM Active Chairman’s Address 2021pdf

- WAM Active Monthly Investment Update October 2021pdf

- Options Fact Sheet November 2021pdf

- WAM Active September 2021 Quarterly Reportpdf

- WAM Active Notice of Meeting 2021pdf

- WAM Active Monthly Investment Update September 2021pdf

- WAM Active Monthly Investment Update August 2021pdf

- FY2021 Key datespdf

- WAM Active FY2021 Full Year Resultpdf

- WAM Active Corporate Governance Charter 2021pdf

- WAM Active Corporate Governance Statement 2021pdf

- WAM Active FY2021 Annual Reportpdf

- WAM Active Monthly Investment Update July 2021pdf

- WAM Active Monthly Investment Update June 2021pdf

- WAM Active Investment Update May 2021pdf

- WAM Active Quarterly Planner Report March 2021pdf

- WAM Active Monthly Investment Update April 2021pdf

- WAM Active Corporate Governance Statement 2020pdf

- WAM Active Monthly Investment Update March 2021pdf

- WAM Active Modern Slavery Statement 2020pdf

- Strong demand for WAM Active SPP and oversubscribed Placement raises more than $25.2 millionpdf

- WAM Active March 2021 investment portfolio performance and NTA updatepdf

- February 2021 investment portfolio performance & NTA updatepdf

- WAM Active Monthly Investment Update February 2021pdf

- WAM Active FY2021 Half Year Resultpdf

- WAM Active February 2021 Options Prospectuspdf

- WAM Active FY2021 Share Purchase Plan Bookletpdf

- WAM Active SPP & Placement announcementpdf

- WAM Active December 2020 Quarterly Reportpdf

- WAM Active FY2021 Half Year Resultpdf

- WAM Active Monthly Investment Update January 2021pdf

- WAM Active Anti-Bribery and Corruption policypdf

- WAM Active Monthly Investment Update December 2020pdf

- WAM Active FY2021 Interim Financial Reportpdf

- WAM Active Monthly Investment Update November 2020pdf

- WAM Active Chairman’s Address 2020pdf

- WAM Active Monthly Investment Update October 2020pdf

- WAM Active Notice of Meeting 2020pdf

- WAM Active Monthly Investment Update September 2020pdf

- WAM Active Monthly Investment Update August 2020pdf

- FY2021 Key Datespdf

- WAM Active FY2020 Annual Reportpdf

- WAM Active FY2020 Full Year Resultpdf

- WAM Active Monthly Investment Update July 2020pdf

- WAM Active Investment Update June 2020pdf

- WAM Active Investment Update May 2020pdf

- WAM Active Corporate Governance Charter 2020pdf

- WAM Active Investment Update April 2020pdf

- WAM Active Investment Update March 2020pdf

- FY2020 Key Datespdf

- WAM Active cancellation of Share Purchase Planpdf

- WAM Active Investment Update February 2020pdf

- WAM Active Share Purchase Plan Announcementpdf

- WAM Active Share Purchase Planpdf

- WAM Active FY2020 Half Year Resultpdf

- WAM Active Investment Update January 2020pdf

- WAM Active Investment Update December 2019pdf

- WAM Active FY2020 Interim Financial Reportpdf

- WAM Active Whistleblower Policy 2019pdf

- WAM Active Investment Update November 2019pdf

- WAM Active Investment Update October 2019pdf

- WAM Active Investment Update September 2019pdf

- WAM Active Investment Update August 2019pdf

- WAM Active FY2019 Annual Reportpdf

- WAM Active Corporate Governance Statement 2019pdf

- WAM Active FY2019 Full Year Resultpdf

- FY2019 Key Datespdf

- WAM Active Investment Update July 2019pdf

- WAM Active Investment Update June 2019pdf

- WAM Active Investment Update May 2019pdf

- WAM Active Corporate Governance Charter 2019pdf

- WAM Active Chairman’s Address 2019pdf

- WAM Active investment update April 2019pdf

- Zenith Annual Report – WAM Activepdf

- WAM Active March 2019 Investment Updatepdf

- WAM Active February 2019 Investment Updatepdf

- WAM Active January 2019 Investment Updatepdf

- WAM Active December 2018 Investment Updatepdf

- WAM Active FY2019 Half Year Resultpdf

- WAM Active November 2018 Investment Updatepdf

- WAM Active October 2018 Investment Updatepdf

- WAA September 2018 Investment updatepdf

- WAM Active FY2018 Annual Reportpdf

- WAM Active FY2018 Full Year Resultpdf

- June 2018 Investment updatepdf

- WAM Active May 2018 Investment updatepdf

- WAM Active Chairman’s Address 2018pdf

- WAM Active Corporate Governance Charter 2018pdf

- April 2018 Investment Updatepdf

- March 2018 Investment updatepdf

- IIR WAA March 2018pdf

- February 2018 Investment updatepdf

- WAM Active FY2018 Half Year Resultpdf

- January 2018 Investment updatepdf

- December 2017 Investment updatepdf

- WAM Active FY2018 Interim Financial Reportpdf

- November 2017 Investment updatepdf

- WAM Active Chairman’s Address 2017pdf

- October 2017 Investment updatepdf

- September 2017 Investment updatepdf

- WAM Active DRP rulespdf

- August 2017 Investment updatepdf

- WAM Active Corporate Governance Charter 2017pdf

- Annual Report FY2017pdf

- WAM Active FY2017 Full Year Resultpdf

- WAM Active – July 2017pdf

- June 2017 Investment updatepdf

- May 2017 Investment updatepdf

- April 2017 Investment updatepdf

- March 2017 Investment updatepdf

- February 2017 Investment updatepdf

- WAM Active FY2017 Half Year Resultpdf

- January 2017 Investment updatepdf

- December 2016 Investment Updatepdf

- November 2016 Investment updatepdf

- WAM Active FY2017 Interim Financial Reportpdf

- WAM Active Chairman’s Address 2016pdf

- October 2016 Investment updatepdf

- September 2016 investment updatepdf

- Annual Report FY2016pdf

- August 2016 Investment updatepdf

- July 2016 Investment Updatepdf

- June 2016 Investment Updatepdf

- May 2016 Investment Updatepdf

- April 2016 Investment Updatepdf

- March 2016 Investment Updatepdf

- February 2016 Investment Updatepdf

- January 2016 Investment Updatepdf

- December 2015 Investment Updatepdf

- WAM Active FY2016 Interim Financial Reportpdf

- November 2015 Investment Updatepdf

- October 2015 Investment Updatepdf

- September 2015 Investment Updatepdf

- August 2015 Investment Updatepdf

- July 2015 Investment Updatepdf

- Annual Report FY2015pdf

- June 2015 Investment Updatepdf

- May 2015 Investment Updatepdf

- April 2015 Investment Updatepdf

- March 2015 Investment Updatepdf

- February 2015 Investment Updatepdf

- January 2015 Investment Updatepdf

- December 2014 Investment Updatepdf

- WAM Active FY2015 Interim Financial Reportpdf

- November 2014 Investment Updatepdf

- October 2014 Investment Updatepdf

- September 2014 Investment Updatepdf

- August 2014 Investment Updatepdf

- July 2014 Investment Updatepdf

- Annual Report FY2014pdf

- June 2014 Investment Updatepdf

- May 2014 Investment Updatepdf

- April 2014 Investment Updatepdf

- March 2014 Investment Updatepdf

- February 2014 Investment Updatepdf

- January 2014 Investment Updatepdf

- Independent Investment Research Quarterly Review – Dec 13pdf

- December 2013 Investment Updatepdf

- WAM Active FY2014 Interim Financial Reportpdf

- November 2013 Investment Updatepdf

- October 2013 Investment Updatepdf

- September 2013 Investment Updatepdf

- August 2013 Investment Updatepdf

- July 2013 Investment Updatepdf

- Annual Report FY2013pdf

- June 2013 Investment Updatepdf

- May 2013 Investment Updatepdf

- April 2013 Investment Updatepdf

- March 2013 Investment Updatepdf

- February 2013 Investment Updatepdf

- January 2013 Investment Updatepdf

- December 2012 Investment Updatepdf

- WAM Active FY2013 Interim Financial Reportpdf

- November 2012 Investment Updatepdf

- October 2012 Investment Updatepdf

- September 2012 Investment Updatepdf

- August 2012 Investment Updatepdf

- July 2012 Investment Updatepdf

- June 2012 Investment Updatepdf

- Annual Report FY2012pdf

- May 2012 Investment Updatepdf

- April 2012 Investment Updatepdf

- March 2012 Investment Updatepdf

- February 2012 Investment Updatepdf

- January 2012 Investment Updatepdf

- December 2011 Investment Updatepdf

- WAM Active FY2012 Interim Financial Reportpdf

- November 2011 Investment Updatepdf

- October 2011 Investment Updatepdf

- September 2011 Investment Updatepdf

- August 2011 Investment Updatepdf

- July 2011 Investment Updatepdf

- Annual Report FY2011pdf

- June 2011 Investment Updatepdf

- May 2011 Investment Updatepdf

- April 2011 Investment Updatepdf

- March 2011 Investment Updatepdf

- February 2011 Investment Updatepdf

- January 2011 Investment Updatepdf

- December 2010 Investment Updatepdf

- November 2010 Investment Updatepdf

- October 2010 Investment Updatepdf

- September 2010 Investment Updatepdf

- August 2010 Investment Updatepdf

- July 2010 Investment Updatepdf

- Annual Report FY2010pdf

- June 2010 Investment Updatepdf

- WAM Active FY2011 Interim Financial Reportpdf

- May 2010 Investment Updatepdf

- April 2010 Investment Updatepdf

- March 2010 Investment Updatepdf

- February 2010 Investment Updatepdf

- January 2010 Investment Updatepdf

- December 2009 Investment Updatepdf

- WAM Active FY2010 Interim Financial Reportpdf

- November 2009 Investment Updatepdf

- October 2009 Investment Updatepdf

- September 2009 Investment Updatepdf

- August 2009 Investment Updatepdf

- July 2009 Investment Updatepdf

- June 2009 Investment Updatepdf

- Annual Report FY2009pdf

- April 2009 Investment Updatepdf

- March 2009 Investment Updatepdf

- February 2009 Investment Updatepdf

- January 2009 Investment Updatepdf

- December 2008 Investment Updatepdf

- WAM Active FY2009 Interim Financial Reportpdf

- November 2008 Investment Updatepdf

- October 2008 Investment Updatepdf

- September 2008 Investment Updatepdf

- August 2008 Investment Updatepdf

- July 2008 Investment Updatepdf

- June 2008 Investment Updatepdf

- Annual Report FY2008pdf

- May 2008 Investment Updatepdf

- April 2008 Investment Updatepdf

- March 2008 Investment Updatepdf

- February 2008 Investment Updatepdf

- January 2008 Investment Updatepdf

- WAM Active prospectuspdf